Are you tired of the traditional banking hassles that often feel like a time-consuming chore? Digital banking offers a revolutionary shift, providing unprecedented convenience and control over your finances, right at your fingertips.

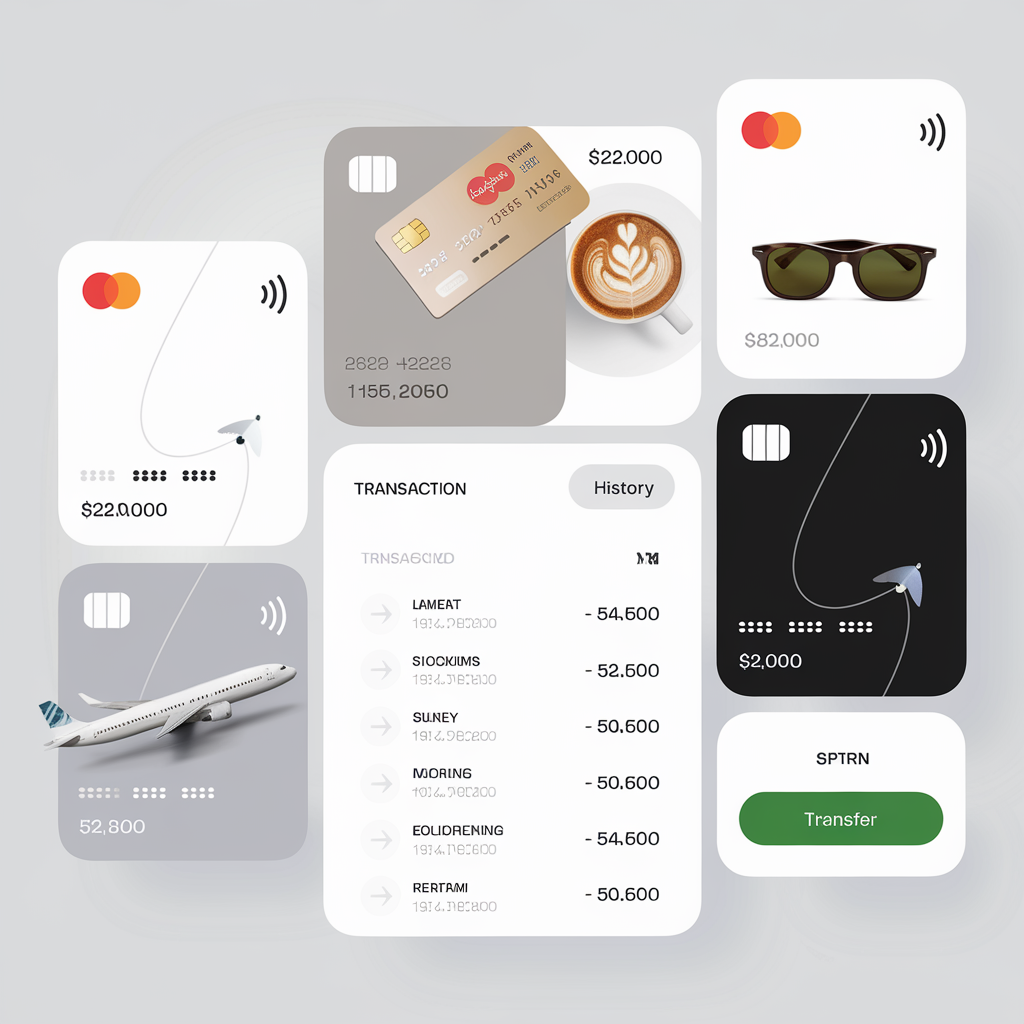

Digital banking, a concept that has rapidly transformed the financial landscape, empowers individuals to manage their finances anytime, anywhere. Whether you're at home, on the go, or even traveling across continents, access to your accounts, bill payments, money transfers, and much more is readily available through secure online platforms and mobile applications. This modern approach simplifies financial management, offering a streamlined and efficient alternative to conventional banking methods.

Let's delve deeper into the world of digital banking. We will explore the key features, benefits, and practical aspects of this transformative financial tool.

| Feature | Description | Benefit |

|---|---|---|

| Account Access | View account balances, transaction history, and statements. | Real-time overview of your financial position. |

| Bill Payment | Schedule and pay bills directly from your account. | Avoid late fees and simplify payment management. |

| Money Transfers | Transfer funds between your accounts and to other individuals or institutions. | Convenient and fast way to move money. |

| Mobile Banking | Access banking services via mobile apps on smartphones and tablets. | Banking on the go, anytime, anywhere. |

| Security Features | Multi-factor authentication, encryption, and fraud detection. | Protection against unauthorized access and financial theft. |

| Budgeting Tools | Track income, expenses, and set financial goals. | Improved financial planning and control. |

| Customer Support | Access to customer service through various channels (chat, email, phone). | Prompt assistance with banking-related issues. |

Several financial institutions are at the forefront of digital banking, offering a variety of services. Capital One, for instance, provides a comprehensive digital platform where users can sign in to access their accounts, view balances, pay bills, and transfer money. Similarly, Advia Credit Union and Orion Financial offer user-friendly digital banking apps that enable customers to manage their finances conveniently. Truist Bank, through its digital banking solutions, provides access to commercial banking, trust services, and asset management. TD Bank offers online banking solutions that are designed to be simple and accessible to its customers.

The application process and usage of digital banking platforms often vary, but generally involve a straightforward enrollment process. For instance, "combank digital" can be accessed by enrolling online without submitting any documents. However, for joint accounts, a request letter signed by all account holders may be necessary. First Citizens emphasizes that there are no fees to download or access their digital banking services, although mobile carrier fees may apply.

The benefits of embracing digital banking are numerous. By opting for digital banking solutions, individuals can easily manage their money anytime and anywhere. These platforms typically provide access to essential tools, such as streamlined account views, virtual card management, and mobile wallet integration. The ability to check your credit score, transfer money, customize your account, or budget like a pro is all within reach. Digital banking simplifies financial lives and provides greater control. Digital banking platforms are designed to be user-friendly and intuitive, making it easier for customers to perform their banking tasks.

Security remains a paramount concern in the digital realm. Users are advised to use strong, unique passwords that combine letters, numbers, and symbols. Regularly monitoring account activity and being vigilant against phishing attempts are also essential. Always ensure that you are accessing secure websites, and never share personal information with unverified sources. In the case of any suspicious activity, promptly contact your financial institution.

Digital banking, while incredibly convenient, also comes with potential pitfalls. One common issue is the risk of phishing, where malicious actors attempt to steal your credentials through fake websites or emails. Another is the threat of malware, which can compromise your device and steal your banking information. In addition, reliance on digital platforms can sometimes lead to service disruptions, particularly during system upgrades or technical issues.

Here are some tips to stay secure while using digital banking:

- Use strong, unique passwords.

- Regularly monitor your account activity.

- Be wary of phishing attempts.

- Keep your software up to date.

- Use secure networks.

- Report any suspicious activity.

Digital banking is constantly evolving, with new features and enhancements being introduced to improve user experience. For instance, some institutions are now providing virtual card numbers for online transactions, eliminating the need for a physical card. Enhancements are being made to deliver a quick, seamless, and more intuitive experience. With the development of secure payment solutions, the process of online transactions has never been so smooth.

As digital banking continues to evolve, so too will the security measures in place. Banks are continuously investing in advanced security protocols such as biometric authentication, artificial intelligence-driven fraud detection, and end-to-end encryption to protect customer data and funds.

Several financial institutions offer robust digital banking solutions. Consider the features that best meet your needs.Here are a few examples:

- Capital One: Comprehensive account management, bill payment, and money transfer features.

- Advia Credit Union: User-friendly digital banking app.

- Truist Bank: Offers digital banking with various banking services.

- TD Bank: Provides online banking solutions that are designed to be simple and accessible to its customers.

- Psecu: Manage your card and view your virtual card number,

- Merchants Bank: Convenient and secure banking features.

- Orion Financial: Offers secure and seamless access to your finances.

- First Citizens: Digital banking app with a wide range of functionalities.

Digital banking is revolutionizing the way individuals manage their finances, offering unparalleled convenience, accessibility, and control. By taking advantage of the features and services provided, users can simplify their financial lives, save time, and bank from anywhere.