Is the future of finance truly at our fingertips? Digital banking is no longer a futuristic concept; it's the present, offering unparalleled convenience, security, and control over our financial lives, 24/7.

The financial landscape has undergone a seismic shift in recent years, driven by technological advancements and evolving consumer expectations. Traditional banking models, with their reliance on physical branches and limited operating hours, are rapidly giving way to a digital ecosystem where individuals can manage their finances from virtually anywhere, at any time. This transformation is not just about convenience; it's about empowerment. Digital banking puts the power back in the hands of the account holder, providing a level of control and insight that was previously unimaginable.

This digital revolution, however, necessitates a critical understanding of its intricacies. While the benefits are undeniable, navigating the world of online banking requires a discerning eye and a proactive approach to security. We must be informed consumers, aware of the potential pitfalls and equipped to protect ourselves from fraud and cyber threats. This article aims to provide a comprehensive overview of the digital banking landscape, exploring its features, benefits, and the essential steps needed to ensure a safe and secure financial experience.

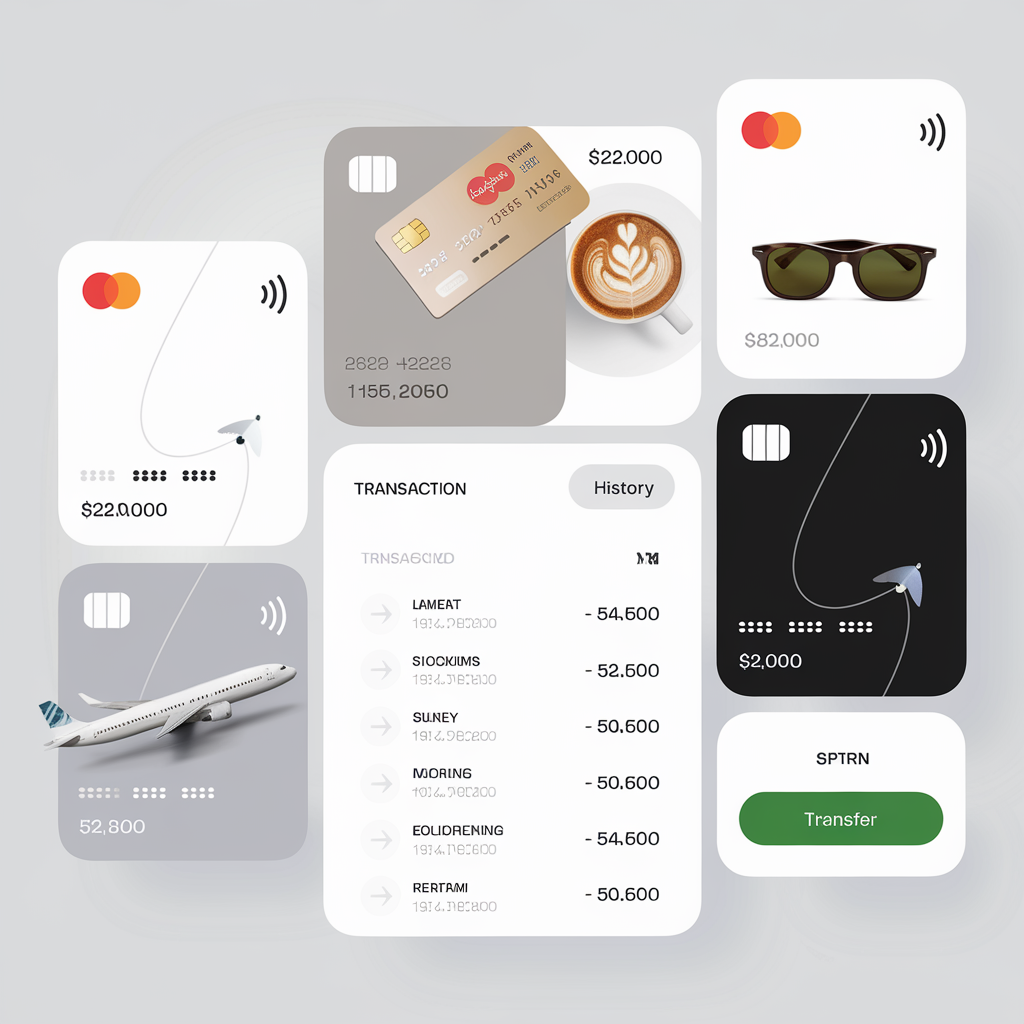

Digital banking platforms, regardless of the institution, are built upon a foundation of core functionalities. These include the ability to access account information, view transaction history, transfer funds between accounts, pay bills, and track spending. Many platforms also offer advanced features like budgeting tools, financial planning resources, and the ability to set up automated savings plans. The user experience is paramount, with intuitive interfaces and mobile applications designed to make managing finances as seamless and straightforward as possible. Whether you're accessing your accounts from a computer, laptop, or mobile phone, digital banking offers unprecedented flexibility and accessibility.

For many, the greatest advantage of digital banking lies in its accessibility. Regardless of your location or the time of day, you can access your accounts and manage your finances. This is particularly beneficial for individuals with busy schedules or those who live in areas with limited access to traditional banking services. Furthermore, the ability to monitor transactions in real-time and receive instant notifications about account activity provides a level of transparency and control that can help prevent fraud and unauthorized charges.

However, the digital realm is not without its challenges. Cybersecurity is a constant concern, and it's crucial to adopt a proactive approach to protect personal and financial information. This includes using strong, unique passwords, enabling multi-factor authentication, and being vigilant about phishing attempts and other scams. Never divulge your credentials, even if the request seems legitimate. Banks will never ask for sensitive information via email or SMS.

Many financial institutions have taken extra measures to help their customers in this regard. For example, "First Citizens does not charge fees to download or access First Citizens digital banking, including the First Citizens mobile banking app." This indicates that the bank focuses on customer convenience. This may not be the case with all institutions and "Fees may apply for use of certain services in first citizens digital banking." "Mobile carrier fees may apply for data and text message usage. Check with your carrier for more information." It is important to inquire with your institution about these charges, and plan accordingly.

Beyond the basic functionalities, digital banking offers a range of specialized services that can further enhance financial management. For example, many platforms offer bill payment services, allowing you to schedule payments and avoid late fees. Others provide budgeting tools that help you track your spending and identify areas where you can save money. Some institutions even offer integration with other financial applications, such as personal finance management tools, to provide a more comprehensive view of your financial health.

Credit unions and other financial institutions are increasingly leveraging the power of digital banking to offer an even more personalized experience. For example, "As a member of Credit Union 1, you will have access to our highly rated digital and mobile banking that keeps your money at your fingertips, wherever you go. Pay bills, transfer funds, track spending, and more through a highly personalized digital banking experience."

The user interface plays a vital role in the overall experience of digital banking. Financial institutions invest heavily in user-friendly interfaces and intuitive mobile applications, as they are crucial in creating a smooth experience for the customer. In many cases, it is much easier to handle financial information through digital platforms than traditional, paper based financial management.

In order to ensure customer safety and security, some institutions are implementing advanced security measures. One such measure is to lock out individuals who are unsuccessful in multiple attempts to log into an account. "For your security, we will lock out anyone who is unsuccessful in multiple attempts to log into your account."

Not all digital banking experiences are created equal. Consider the following, as you navigate through digital banking, so that you will avoid security issues:

- Check spelling or type a new query.

- Digital banking login login id.

- "Banca mps non chiede mai le tue credenziali via email, sms, telefono o social. Anche se la richiesta sembra provenire dalla banca non fornire per nessun motivo il pin, i codici delle tue carte, le credenziali di digital banking o le tue password, anche quelle temporanee (otp) inviate tramite sms per autorizzare le disposizione di pagamento. You should therefore, never divulge such information even if asked for."

The digital world is constantly evolving. Banks are aware of this, and work to remain on the leading edge. "We understand that social obligations and the daily grind mean you need to get things done quickly and easily. So because time shouldn't be wasted, we're upgrading and revamping our internet banking, affording you the opportunity to get your tasks done even faster and at your own leisure."

Some institutions provide additional resources, such as business accounts: "Personal and small business bank accounts; My business suite of tools (coming soon)". The convenience and financial power digital banking provide cannot be overstated, and the trend is likely to continue.

| Feature | Description |

|---|---|

| Account Access | View balances, transaction history, and account details from any device with internet access. |

| Fund Transfers | Transfer funds between your accounts or to external accounts. |

| Bill Payment | Schedule and pay bills online, often with options for recurring payments. |

| Mobile Deposit | Deposit checks by taking a picture with your smartphone or tablet. |

| Budgeting Tools | Track spending, create budgets, and analyze your financial habits. |

| Security Features | Multi-factor authentication, fraud alerts, and secure login protocols to protect your accounts. |

| Customer Service | Access to customer support via chat, email, or phone. |

| Alerts and Notifications | Receive notifications about account activity, low balances, and other important events. |

To fully embrace the benefits of digital banking, one must understand that security is a shared responsibility. While financial institutions invest heavily in security measures, users also play a crucial role in protecting their financial information. This requires a combination of strong passwords, multi-factor authentication, and a healthy dose of skepticism when it comes to unsolicited requests for personal information. Never share your login credentials, PINs, or other sensitive data with anyone, regardless of how legitimate the request may seem. If you suspect your account has been compromised, contact your bank immediately to report the incident and take steps to secure your accounts.

The future of digital banking is bright, with continuous innovation and the evolution of the user experience. Financial institutions are always trying to develop easier and safer features. Several institutions offer advanced features like the ability to view virtual card numbers and push cards directly to mobile wallets. This provides a lot of convenience. "Using our latest digital banking feature, you can reap the benefits of your psecu card even if you dont have the physical card! Simply log into digital banking and go to manage cards to view your virtual card number. The new feature also makes it super easy to push your card directly to your mobile wallet."

Many different institutions offer digital banking services. They are all vying for your attention. "Enroll in digital banking today to enjoy secure, convenient financial management. Join advia today to access digital banking." Other services include "Civista digital banking gives you the convenient access and security features to easily manage your money anytime, anywhere and financial tools for more control and insight into your spending and saving." and "From the general assembly building to the most remote duty station, unfcu digital banking puts your accounts at your fingertips. Enroll today to manage all of your accounts on one platform, securely accessible from your computer, laptop, or mobile phone."

As we move forward, digital banking is poised to become even more sophisticated and integrated into our daily lives. We will likely see further advancements in areas such as artificial intelligence, personalized financial advice, and the seamless integration of financial services with other aspects of our digital ecosystem. Those that are ready to accept this revolution will be better positioned to succeed.

In conclusion, digital banking has revolutionized the way we manage our finances, offering unprecedented convenience, accessibility, and control. However, with these benefits come responsibilities. By understanding the features, embracing the security measures, and practicing vigilance, we can navigate the digital banking landscape with confidence and enjoy the full benefits of this financial evolution. "Take charge of your finances with bpi's online banking platform, and make transfers, check balances, pay bills, view transactions and more. Digital banking gives you complete and secure control of your account from anywhere you access the internet, 24/7."