Are you ready to revolutionize the way you manage your finances? Digital banking is no longer a futuristic concept; it's the present and, more importantly, the key to unlocking financial freedom and convenience in today's fast-paced world.

Forget the constraints of traditional banking the long queues, limited hours, and geographical limitations. Digital banking, at its core, is about putting you in complete control of your finances, anytime, anywhere. Its about accessing your accounts, making transactions, and managing your money with unprecedented ease and efficiency, all from the convenience of your smartphone or computer. From the bustling streets of Kuala Lumpur to the serene landscapes of the Philippines, the promise of digital banking beckons, promising a future where financial management is as seamless as it is secure.

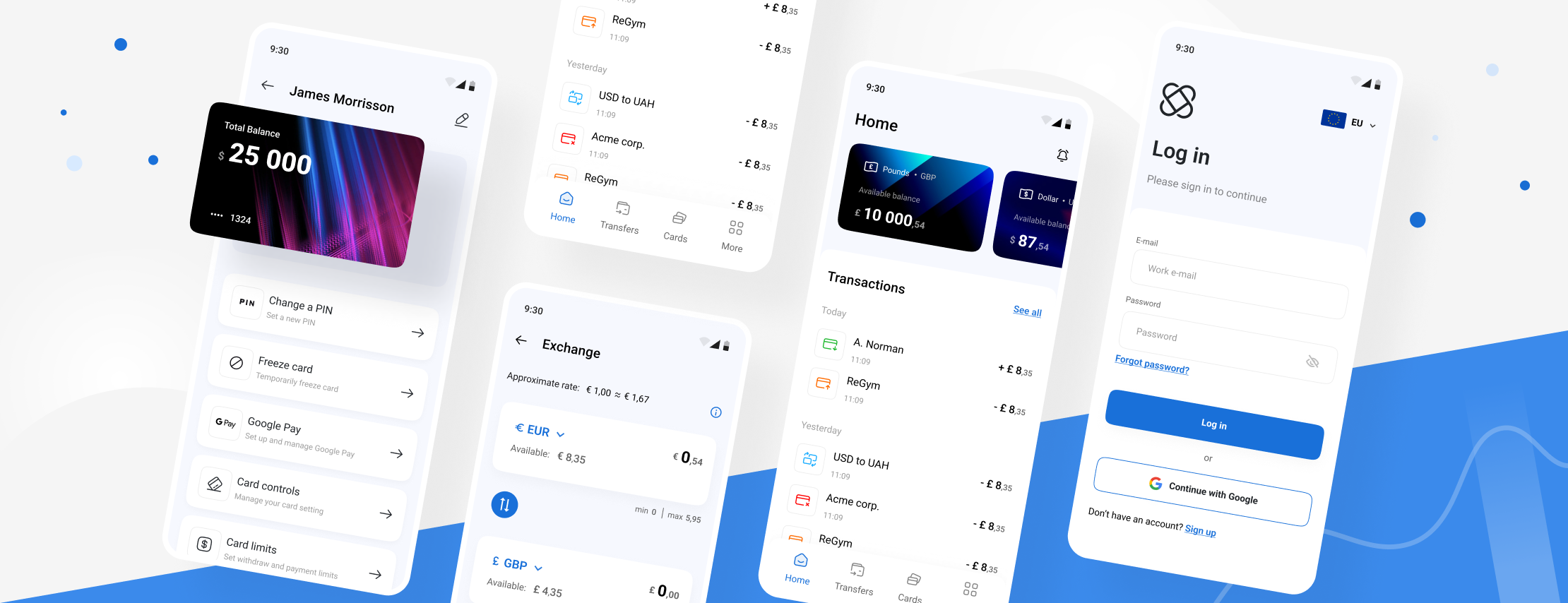

Digital banking is rapidly transforming the financial landscape. This article provides a comprehensive overview of the best mobile banking apps, breaking down their features and functionalities to help you make informed decisions about your financial future. Whether you're a seasoned investor or just starting to navigate the world of personal finance, this guide will equip you with the knowledge you need to select the digital banking solutions that best align with your goals.

| Category | Details |

|---|---|

| Definition of Digital Banking | Performing banking activities online or through a mobile app, rather than visiting a physical branch. This includes checking account balances, transferring funds, paying bills, and even applying for loans. |

| Key Benefits of Digital Banking |

|

| Common Features | Mobile check deposit, bill pay, money transfers, account management, budgeting tools, and security features like touch ID and face ID. |

| Examples of Digital Banking Apps |

|

| Security Measures |

|

| Important Considerations |

|

| How to Open a Digital Bank Account | Download the banks mobile app, submit your valid ID, and complete the KYC (Know Your Customer) process online. |

| Digital Banking and Financial Inclusion | Digital banking solutions like those offered by Coyyn.com are playing a significant role in expanding financial services to underserved communities by removing the need for a physical branch. |

One of the most compelling advantages of digital banking is its inherent convenience. Imagine managing your finances from anywhere in the world, at any time of day or night. The BOC digital banking app, for instance, epitomizes this ease, providing a streamlined experience that puts all your banking needs right at your fingertips. Whether you're checking your balance, transferring funds, or paying bills, the process is quick, secure, and incredibly user-friendly. This level of accessibility is a game-changer, freeing you from the constraints of traditional banking hours and locations.

The BMO digital banking app offers another compelling example of this convenience, putting the control of your money directly in your palm. Features like touch ID and Face ID provide rapid and secure access to your accounts, allowing you to skip the trip to the branch or ATM. Mobile deposit capabilities further enhance this convenience, enabling you to deposit checks simply by taking a picture of them.

The Bank of America digital banking app, along with others, provides similar functionalities. Moreover, these apps are increasingly prioritizing security. For example, setting up travel notices within the app ensures uninterrupted access to your accounts, even when traveling abroad.

The accessibility extends to account opening as well. Opening an account with a digital bank is often incredibly straightforward and completely online. In Malaysia and many other locations, the process is simplified, allowing you to download the banks mobile app, submit your identification, and complete the KYC (Know Your Customer) process with ease. This ease of access is transforming the banking landscape, making financial services more inclusive and accessible than ever before.

However, with convenience comes the need for heightened vigilance, especially in the realm of online security. While banks invest heavily in technologies to fortify their systems, it is essential to recognize that online channels can still be vulnerable to threats such as hacking, identity theft, and fraudulent activities. This is an issue that the digital banking industry acknowledges and constantly works to mitigate.

Digital banking has a significant role to play in financial inclusion. By providing online banking solutions that don't require a physical branch, digital platforms like Coyyn.com make financial services accessible to individuals in remote areas or those who face difficulties reaching a traditional bank. This is a vital step in bridging the financial gap and empowering individuals with greater control over their financial lives.

The landscape of digital banking is rapidly evolving, and with it, the tools available to manage your finances. From savings and investment apps to platforms for buying and selling using Amazon, cryptocurrency, and PayPal, digital banking provides a comprehensive suite of services.

The Coyyn.com digital banking app stands out as a leader in providing seamless, secure, and user-friendly services. The app incorporates features like mobile check deposit, bill pay, and money transfers, ensuring users can stay connected to their accounts on the go, offering flexibility and control from anywhere.

Axos Bank, First Citizens, and others, while providing similar services, focus on unique features to enhance the user experience. First Citizens, for example, distinguishes itself by not charging fees for downloading or accessing its digital banking services. However, its essential to be aware that mobile carrier fees may apply for data and text message usage, and some specific services may incur fees.

The article explores the advantages of digital banking, providing a glimpse into the future of financial management. It's a future where banking is convenient, accessible, and secure, putting you firmly in the drivers seat.

The evolution of banking through mobile phone apps has brought about a paradigm shift in how we manage our finances. This transformation has given rise to a plethora of innovative solutions, enabling users to perform banking tasks from anywhere. Mobile banking app users can deposit checks just by taking a picture of them, with mobile deposit footnote 6 6, skip the branch or ATM. The trend continues, emphasizing the growing influence of digital banking and the numerous advantages it offers.

While the digital banking revolution offers unprecedented convenience, it's crucial to remain vigilant. While banks invest in robust security measures, online banking channels are still vulnerable to potential threats, including hacking, identity theft, and other fraudulent activities.

One question that arises is: can you deposit cash into a digital bank? The answer varies depending on the bank's specific policies.

Here are some key takeaways from the discussion:

- Digital banking offers convenience and control.

- Mobile apps provide features such as mobile check deposit and bill pay.

- Security is paramount, and users should take steps to protect their accounts.

- Digital banking is playing a role in financial inclusion.

Digital banking is a dynamic field, constantly evolving to meet the needs of modern users. From seamless transactions to enhanced security measures, the future of banking is here. Whether you're seeking the best mobile banking apps or exploring the opportunities that digital finance offers, it's time to embrace the convenience, efficiency, and power of digital banking.